Birmingham, MI USDA Loan Eligibility

Introduction to USDA Home Loans

The United States Department of Agriculture (USDA) home loan program offers unique opportunities for homeownership in rural and suburban areas. These loans are designed to promote prosperity in and around Birmingham, MI. making it easier for low-to-moderate-income individuals and families to own a home. Birmingham, MI USDA loans come with several benefits, including no down payment, lower mortgage insurance, and competitive interest rates.

Eligibility Criteria Birmingham, MI USDA Home Loans

1. Location Eligibility

- Rural and Suburban Areas: The property must be located in an area that is designated as rural by the USDA. This often includes suburban and rural areas like Birmingham, MI.

- USDA Property Information: Use our USDA help line 888-767-0554 to check if a specific address or area is eligible.

2. Income Eligibility

- Income Limits: Your household income must not exceed 115% of the median income of the area.

- Adjusted Income: Consideration of certain deductions might lower your adjusted income, potentially qualifying you for the program.

3. Credit Requirements

- Credit Score: A credit score of 620 or higher is typically required, offering streamlined loan processing.

- Credit History: Applicants with lower scores may still be eligible but must meet stricter underwriting standards.

4. Citizenship and Residency

- Legal Status: Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens.

- Primary Residence: The home financed must be your primary residence.

5. Property Eligibility

- Type of Property: Eligible properties include single-family homes, condos, and manufactured homes that meet specific Birmingham, MI USDA standards.

- Condition of Property: The home must be in good livable condition, adhering to USDA health and safety standards.

Call Today (888)767-0554

Application Process

- Prequalification: Start by getting prequalified with our Birmingham, MI USDA lending team. This gives you an idea of what you might be eligible to borrow.

- Find a Birmingham, MI USDA-Eligible Home: We will help you look up eligible areas.

- Complete the Application: Provide all necessary documentation, including income verification, credit information, and details about the desired property. We will walk you through the process.

- Loan Processing and Underwriting: We will process your application and underwrite the loan.

- Approval and Closing: Once approved, you’ll proceed to closing and can then move into your new home.

Birmingham, Michigan USDA home loans are an excellent option for those looking to buy a home in rural or suburban areas. They offer several benefits over traditional mortgages, including no down payment and more lenient credit requirements. Understanding and meeting the eligibility criteria is crucial for a successful application. Prospective buyers are encouraged to start the process early and work closely with one of our Birmingham, MI USDA professionals.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits Birmingham, IL

Learn More About Birmingham, IL

Birmingham is a city in Oakland County in the U.S. state of Michigan. It is a northern suburb of Detroit located along the Woodward Corridor (M-1). As of the 2010 census, the population was 20,103.[6]

The area comprising what is now the city of Birmingham was part of land ceded by Native American tribes to the United States government by the 1807 Treaty of Detroit.[7] However, settlement was delayed, first by the War of 1812. Afterward the Surveyor-General of the United States, Edward Tiffin, made an unfavorable report regarding the placement of Military Bounty Lands for veterans of the War of 1812.[8][9] Tiffin’s report claimed that, because of marsh, in this area “There would not be an acre out of a hundred, if there would be one out of a thousand that would, in any case, admit cultivation.” In 1818, Territorial Governor Lewis Cass led a group of men along the Indian Trail. The governor’s party discovered that the swamp was not as extensive as Tiffin had supposed. Not long after Cass issued a more encouraging report about the land, interest quickened as to its suitability for settlement.

Get the Latest USDA Mortgage News!

Surprising Michigan Cities Offering USDA Home Loans in 2026

Thinking USDA home loans are only available in deep rural countryside? Think again! In Michigan, USDA Rural Development loans extend far beyond [...]

Surprising Iowa Cities That Qualify for USDA Home Loans in 2026 (0% Down Options)

When most buyers think of USDA home loans, they picture farmland or extremely remote areas. In reality, that assumption couldn’t be further from [...]

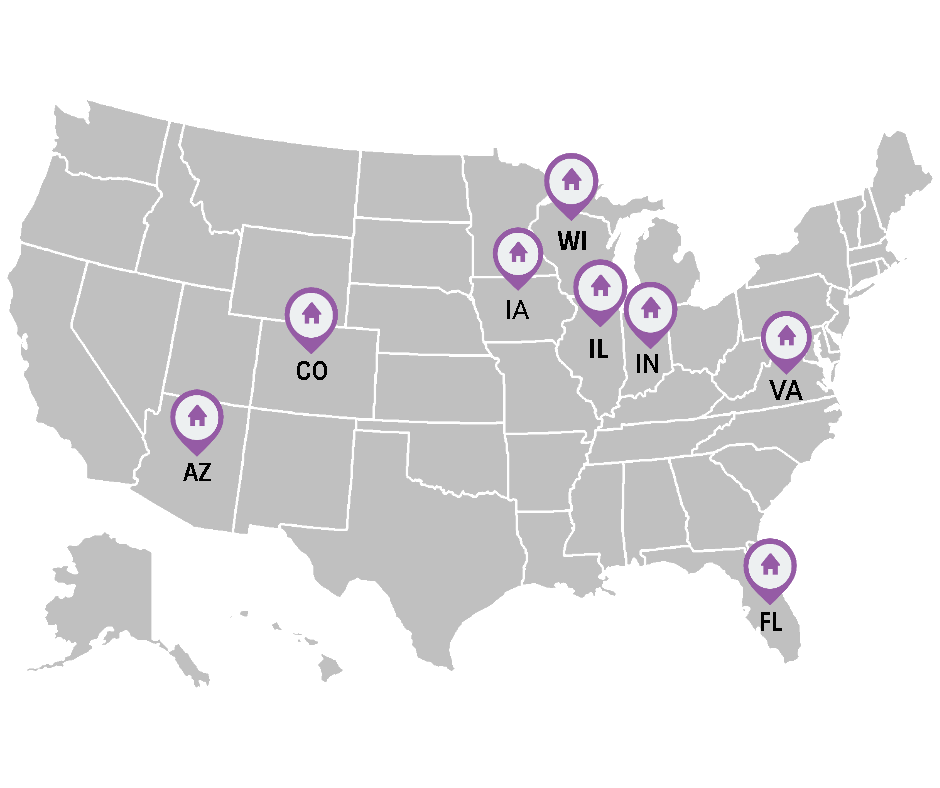

Surprising Arizona Cities That Qualify for USDA Home Loans (0% Down in 2026)

When most buyers think of USDA home loans, they picture remote farmland or tiny desert towns. In reality, many Arizona cities that feel suburban, [...]

2026 USDA Home Loans: Zero-Down Options for Today’s Homebuyers

2026 USDA Home Loans: Why Zero-Down Home Buying Is About to Matter More Than Ever As we head into the end of the year and look toward 2026, one [...]

Why NOW Is the Best Time to Buy in Rural America

The housing market has shifted again in 2025 — and while many buyers feel priced out, USDA Rural Home Loans remain the most affordable path to [...]

Why Waiting to Buy a Home Could Cost You Thousands — The $0 Down USDA Loan Advantage

For many people, the dream of homeownership feels just out of reach. The most common reasons buyers hold back are the belief that they need a [...]

“Why the USDA Home Loan Is Still the Best-Kept Secret in Homebuying—Even in 2025”

If you’re searching for an affordable path to homeownership in 2025, you’ve probably heard of FHA, VA, or conventional loans. But what if the [...]

🏡 Surprising Towns in Alabama That Qualify for USDA Home Loans

If you're dreaming of owning a home in Alabama and think you need a big down payment or perfect credit—think again! The USDA Rural Development [...]

Why the USDA Home Loan Remains One of the Best Options in Today’s Challenging Market

In today’s uncertain economy — with rising mortgage rates, tight housing inventory, and stubborn inflation — many Americans are wondering if [...]

Why the USDA Home Loan Is the Best Option for Homebuyers This Spring

Spring is one of the busiest seasons for real estate, as families and individuals take advantage of the warmer weather and competitive inventory. [...]

Check Birmingham, MI Property Eligibility 888-767-0554.

More Locations we Service in Michigan.