Colorado USDA Loan Benefits

Understanding the Benefits of Colorado USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Colorado, IL. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Colorado USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Colorado is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Colorado USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Colorado USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Colorado USDA Loan

1. Streamlined Refinancing

The Colorado USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Colorado can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Colorado USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

To qualify for a Colorado USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Colorado USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Colorado USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Colorado USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Colorado, IL USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

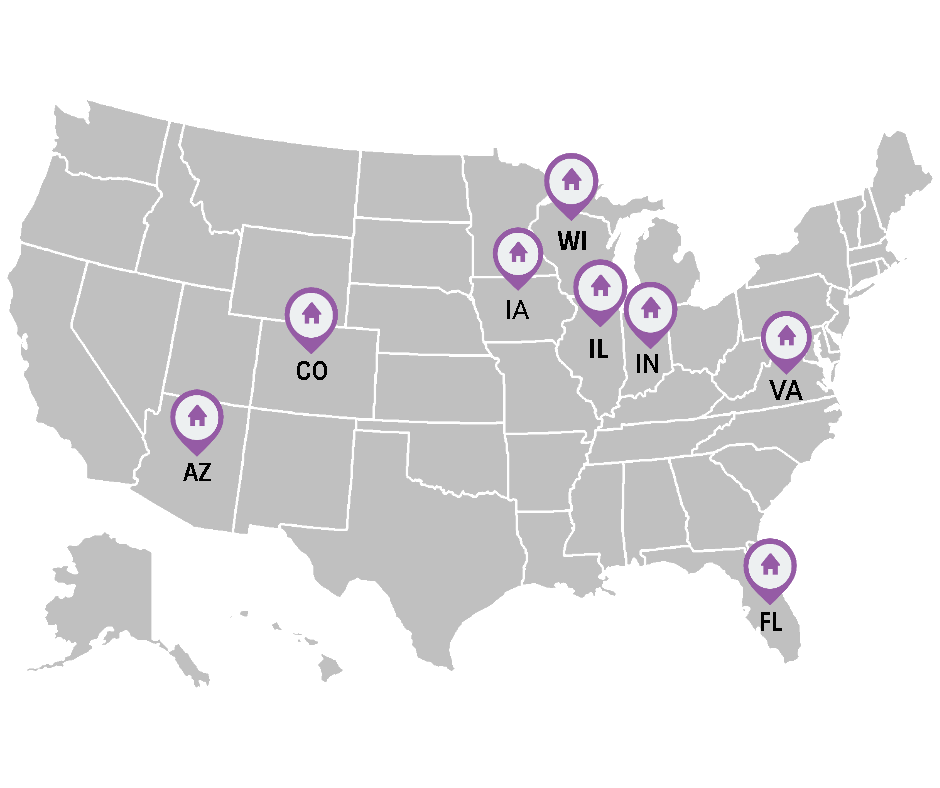

Colorado, IL USDA Maps

Colorado (/ˌkɒləˈrædoʊ, -ˈrɑːdoʊ/ ⓘ KOL-ə-RAD-oh, -RAH-doh,[8][9] other variants[10]) is a landlocked state in the Mountain West subregion of the Western United States. Colorado borders Wyoming to the north, Nebraska to the northeast, Kansas to the east, Oklahoma to the southeast, New Mexico to the south, Utah to the west, and meets Arizona to the southwest at the Four Corners. Colorado is noted for its landscape of mountains, forests, high plains, mesas, canyons, plateaus, rivers, and desert lands. Colorado is one of the Mountain States and is often considered to be part of the southwestern United States. The high plains of Colorado may be considered a part of the midwestern United States. It encompasses most of the Southern Rocky Mountains, as well as the northeastern portion of the Colorado Plateau and the western edge of the Great Plains. Colorado is the eighth most extensive and 21st most populous U.S. state. The United States Census Bureau estimated the population of Colorado at 5,877,610 as of July 1, 2023, a 1.80% increase since the 2020 United States census.[11]

The region has been inhabited by Native Americans and their ancestors for at least 13,500 years and possibly much longer. The eastern edge of the Rocky Mountains was a major migration route for early peoples who spread throughout the Americas. In 1848, much of the Nuevo México region was annexed to the United States with the Treaty of Guadalupe Hidalgo. The Pike’s Peak Gold Rush of 1858–1862 created an influx of settlers. On February 28, 1861, U.S. President James Buchanan signed an act creating the Territory of Colorado,[2] and on August 1, 1876, President Ulysses S. Grant signed Proclamation 230 admitting Colorado to the Union as the 38th state.[3] The Spanish adjective “colorado” means “colored red” or “ruddy”. Colorado is nicknamed the “Centennial State” because it became a state one century (and four weeks) after the signing of the United States Declaration of Independence.

Get the Latest USDA Mortgage News!

Surprising Michigan Cities Offering USDA Home Loans in 2026

Thinking USDA home loans are only available in deep rural countryside? Think again! In Michigan, USDA Rural Development loans extend far beyond [...]

Surprising Iowa Cities That Qualify for USDA Home Loans in 2026 (0% Down Options)

When most buyers think of USDA home loans, they picture farmland or extremely remote areas. In reality, that assumption couldn’t be further from [...]

Surprising Arizona Cities That Qualify for USDA Home Loans (0% Down in 2026)

When most buyers think of USDA home loans, they picture remote farmland or tiny desert towns. In reality, many Arizona cities that feel suburban, [...]

2026 USDA Home Loans: Zero-Down Options for Today’s Homebuyers

2026 USDA Home Loans: Why Zero-Down Home Buying Is About to Matter More Than Ever As we head into the end of the year and look toward 2026, one [...]

Why NOW Is the Best Time to Buy in Rural America

The housing market has shifted again in 2025 — and while many buyers feel priced out, USDA Rural Home Loans remain the most affordable path to [...]

Why Waiting to Buy a Home Could Cost You Thousands — The $0 Down USDA Loan Advantage

For many people, the dream of homeownership feels just out of reach. The most common reasons buyers hold back are the belief that they need a [...]

“Why the USDA Home Loan Is Still the Best-Kept Secret in Homebuying—Even in 2025”

If you’re searching for an affordable path to homeownership in 2025, you’ve probably heard of FHA, VA, or conventional loans. But what if the [...]

🏡 Surprising Towns in Alabama That Qualify for USDA Home Loans

If you're dreaming of owning a home in Alabama and think you need a big down payment or perfect credit—think again! The USDA Rural Development [...]

Why the USDA Home Loan Remains One of the Best Options in Today’s Challenging Market

In today’s uncertain economy — with rising mortgage rates, tight housing inventory, and stubborn inflation — many Americans are wondering if [...]

Why the USDA Home Loan Is the Best Option for Homebuyers This Spring

Spring is one of the busiest seasons for real estate, as families and individuals take advantage of the warmer weather and competitive inventory. [...]

Find out about Colorado USDA Benefits 888-767-0554.

Find out what Colorado USDA Benefits are Available!

- New York USDA Loan Benefits

- South Carolina USDA Loan Benefits

- Rhode Island USDA Loan Benefits

- Hawaii USDA Loan Benefits

- California USDA Loan Benefits

- Pennsylvania USDA Loan Benefits

- Massachusetts USDA Loan Benefits

- Indiana USDA Loan Benefits

- New Hampshire USDA Loan Benefits

- Illinois USDA Loan Benefits

- Alaska USDA Loan Benefits

- Kansas USDA Loan Benefits

- Maryland USDA Loan Benefits

- Nebraska USDA Loan Benefits

- Wisconsin USDA Loan Benefits

- New Mexico USDA Loan Benefits

- Ohio USDA Loan Benefits

- Florida USDA Loan Benefits

- Washington USDA Loan Benefits

- Missouri USDA Loan Benefits

- Oklahoma USDA Loan Benefits

- New Jersey USDA Loan Benefits

- Michigan USDA Loan Benefits

- Iowa USDA Loan Benefits

- Wyoming USDA Loan Benefits

- Oregon USDA Loan Benefits

- Mississippi USDA Loan Benefits

- Louisiana USDA Loan Benefits

- Vermont USDA Loan Benefits

- Connecticut USDA Loan Benefits

- Maine USDA Loan Benefits

- Nevada USDA Loan Benefits

- Utah USDA Loan Benefits

- Arizona USDA Loan Benefits

- Texas USDA Loan Benefits

- Georgia USDA Loan Benefits

- West Virginia USDA Loan Benefits

- Tennessee USDA Loan Benefits

- Alabama USDA Loan Benefits

- Kentucky USDA Loan Benefits

- Virginia USDA Loan Benefits

- South Dakota USDA Loan Benefits

- Minnesota USDA Loan Benefits

- North Carolina USDA Loan Benefits

- North Dakota USDA Loan Benefits

- Arkansas USDA Loan Benefits

- Delaware USDA Loan Benefits

- Montana USDA Loan Benefits

- Puerto RIco USDA Loan Benefits

- Idaho USDA Loan Benefits