Mount Morris, MI USDA Loan Benefits

Understanding the Benefits of Mount Morris USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Mount Morris, MI. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Mount Morris USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Mount Morris is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Mount Morris, Michigan USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Mount Morris, MI USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Mount Morris USDA Loan

1. Streamlined Refinancing

The Mount Morris, MI USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Mount Morris, Michigan can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Mount Morris USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

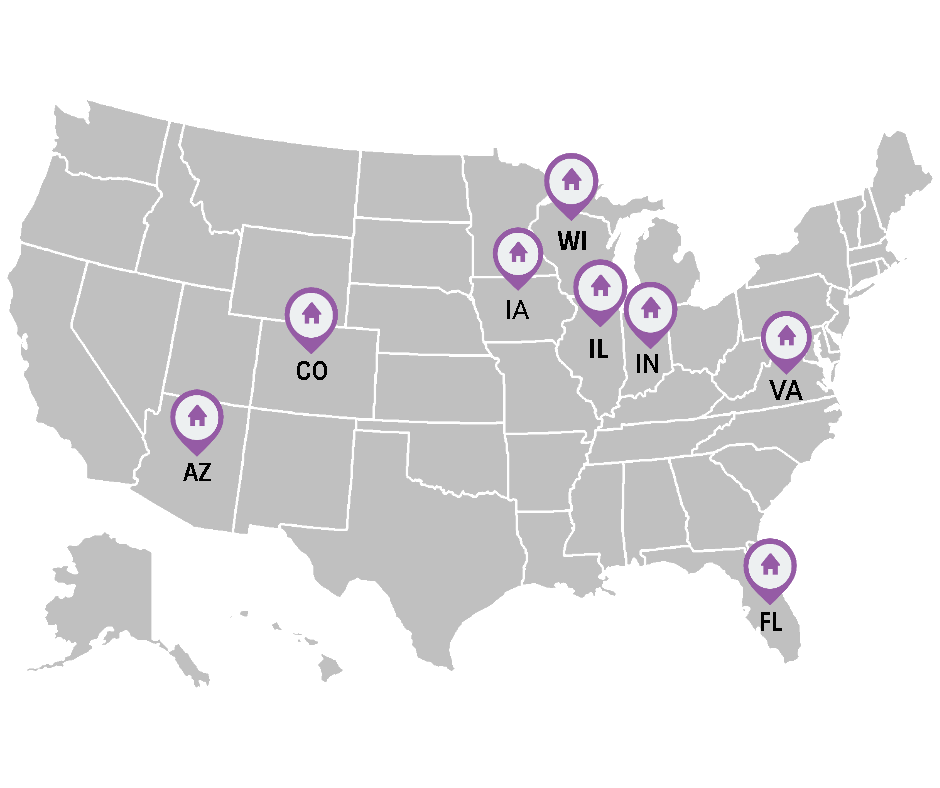

To qualify for a Mount Morris, MI USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Mount Morris, MI USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Mount Morris USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Mount Morris, MI USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Mount Morris, MI USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

Mount Morris, MI USDA Maps

Mount Morris is a city in Genesee County in the U.S. state of Michigan. The population was 3,086 at the 2010 census. The city is bordered by Mount Morris Township on the west and Genesee Township on the east. It was named after Mount Morris, New York, because many of the early settlers had come from there.[4] It is part of the Flint metropolitan area.

Benjamin Pearson was the first settler in the area in 1833. In 1836, Frederick Walker was the first to settle within the future village site. A post office named Mount Morris was established on July 11, 1837, with Charles N. Beecher as the first postmaster. The name of the office was changed to Genesee on January 19, 1839, and back to Mount Morris on April 25, 1857. The name became Mount Morris Station on April 17, 1865, and finally reverted to Mount Morris on March 9, 1874. Development was spurred with the building of a line of the Pere Marquette Railway (now owned by Lake State Railway) in 1857. The settlement was first platted as Dover in 1862 and was incorporated as the village of Mount Morris in 1867. It reincorporated as a city in 1929.[4]

Get the Latest USDA Mortgage News!

Surprising Towns in Texas That Qualify for NO Money Down USDA Home Loans

When people think of USDA home loans, they often picture rural farmland and remote countryside. However, many surprising towns in Texas qualify [...]

Surprising Cities in Indiana That Qualify for a No Money Down USDA Home Loan

When people think of USDA home loans, they often assume that only remote rural areas qualify. However, many surprisingly well-developed and [...]

Surprising Locations in Florida Where You Can Qualify for a Zero Down USDA Home Loan

When most people think of USDA home loans, they picture rural farmland and remote areas. However, Florida has some unexpected locations where you [...]

USDA Home Loans for Barndominiums and the USDA One-Time Close Program

If you’ve been dreaming of owning a unique and spacious home with a rustic yet modern feel, a barndominium might be the perfect option for you. [...]

Surprising Illinois Cities Where USDA Loans Are Available

When people hear "USDA home loan," they often think of rural farmland and remote locations. However, many towns across Illinois—including some [...]

Why Purchasing a New Home with the USDA Mortgage Option is One of the Best for 2025

The dream of owning a home has never been more achievable, thanks to the USDA mortgage program. As we move into 2025, this mortgage option stands [...]

Refinance Made Easy with USDAruralmortgage.com: Unlock Amazing Benefits!

Refinancing your home has never been simpler or more rewarding than with USDAruralmortgage.com. Whether you’re [...]

USDA Home Loans: Top States and Cities Offering No Money Down Options

When it comes to buying a home, one of the biggest hurdles for many buyers is saving for a down payment. Thankfully, USDA home loans eliminate [...]

Holiday Joy with USDA Loans: Real Stories of Homeownership Success

The holiday season is a time of celebration, togetherness, and new beginnings. For many families, it’s also the perfect time to reflect on the [...]

Why Owning a Home in 2025 Is Easier Than You Think

As we step into 2025, the dream of owning a home is more attainable than ever. With the elections behind us, stability in the housing market has [...]

Find out about Mount Morris, MI USDA Benefits 888-767-0554.

Find out what Mount Morris, MI USDA Benefits are Available!