Mount Morris, MI USDA Loan Eligibility

Introduction to USDA Home Loans

The United States Department of Agriculture (USDA) home loan program offers unique opportunities for homeownership in rural and suburban areas. These loans are designed to promote prosperity in and around Mount Morris, MI. making it easier for low-to-moderate-income individuals and families to own a home. Mount Morris, MI USDA loans come with several benefits, including no down payment, lower mortgage insurance, and competitive interest rates.

Eligibility Criteria Mount Morris, MI USDA Home Loans

1. Location Eligibility

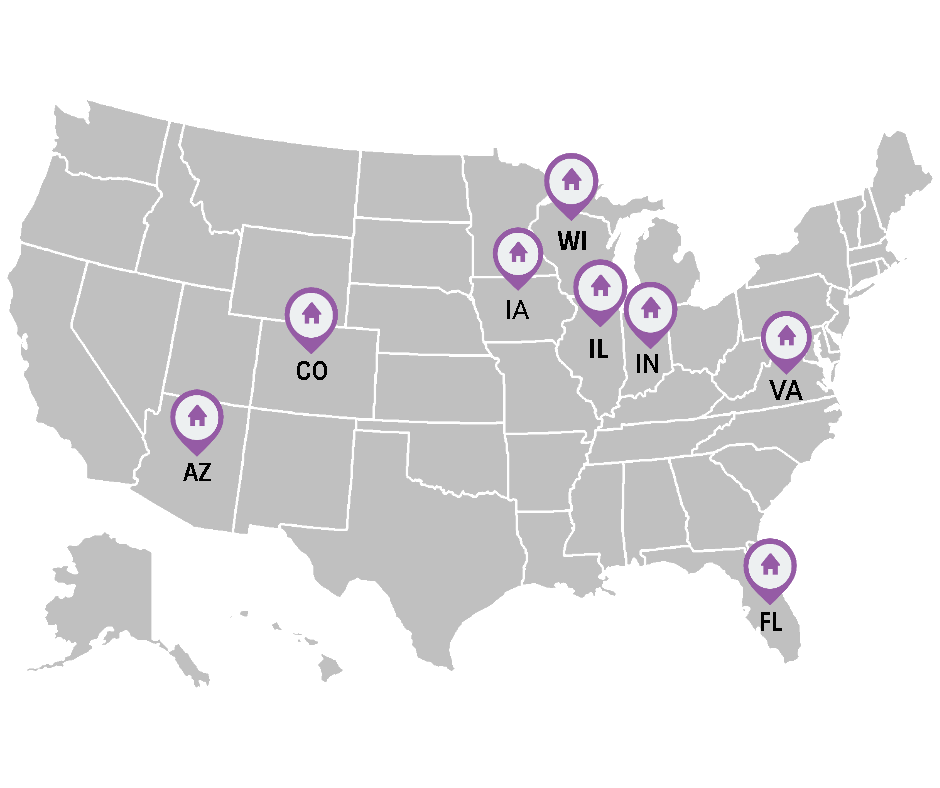

- Rural and Suburban Areas: The property must be located in an area that is designated as rural by the USDA. This often includes suburban and rural areas like Mount Morris, MI.

- USDA Property Information: Use our USDA help line 888-767-0554 to check if a specific address or area is eligible.

2. Income Eligibility

- Income Limits: Your household income must not exceed 115% of the median income of the area.

- Adjusted Income: Consideration of certain deductions might lower your adjusted income, potentially qualifying you for the program.

3. Credit Requirements

- Credit Score: A credit score of 620 or higher is typically required, offering streamlined loan processing.

- Credit History: Applicants with lower scores may still be eligible but must meet stricter underwriting standards.

4. Citizenship and Residency

- Legal Status: Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens.

- Primary Residence: The home financed must be your primary residence.

5. Property Eligibility

- Type of Property: Eligible properties include single-family homes, condos, and manufactured homes that meet specific Mount Morris, MI USDA standards.

- Condition of Property: The home must be in good livable condition, adhering to USDA health and safety standards.

Call Today (888)767-0554

Application Process

- Prequalification: Start by getting prequalified with our Mount Morris, MI USDA lending team. This gives you an idea of what you might be eligible to borrow.

- Find a Mount Morris, MI USDA-Eligible Home: We will help you look up eligible areas.

- Complete the Application: Provide all necessary documentation, including income verification, credit information, and details about the desired property. We will walk you through the process.

- Loan Processing and Underwriting: We will process your application and underwrite the loan.

- Approval and Closing: Once approved, you’ll proceed to closing and can then move into your new home.

Mount Morris, Michigan USDA home loans are an excellent option for those looking to buy a home in rural or suburban areas. They offer several benefits over traditional mortgages, including no down payment and more lenient credit requirements. Understanding and meeting the eligibility criteria is crucial for a successful application. Prospective buyers are encouraged to start the process early and work closely with one of our Mount Morris, MI USDA professionals.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits Mount Morris, IL

Learn More About Mount Morris, IL

Mount Morris is a city in Genesee County in the U.S. state of Michigan. The population was 3,086 at the 2010 census. The city is bordered by Mount Morris Township on the west and Genesee Township on the east. It was named after Mount Morris, New York, because many of the early settlers had come from there.[4] It is part of the Flint metropolitan area.

Benjamin Pearson was the first settler in the area in 1833. In 1836, Frederick Walker was the first to settle within the future village site. A post office named Mount Morris was established on July 11, 1837, with Charles N. Beecher as the first postmaster. The name of the office was changed to Genesee on January 19, 1839, and back to Mount Morris on April 25, 1857. The name became Mount Morris Station on April 17, 1865, and finally reverted to Mount Morris on March 9, 1874. Development was spurred with the building of a line of the Pere Marquette Railway (now owned by Lake State Railway) in 1857. The settlement was first platted as Dover in 1862 and was incorporated as the village of Mount Morris in 1867. It reincorporated as a city in 1929.[4]

Get the Latest USDA Mortgage News!

Navigating your Mortgage in Today’s Market

Navigating Your Mortgage in Today's Market: Why a Consultation Could Save You Thousands If you've purchased a home in the past two years, you're [...]

Preparing to buy a USDA home in the Spring of 2024

Buying a USDA eligible home in the spring of 2024 could be a fantastic opportunity for many individuals and families looking to become [...]

Understanding Construction to Permanent Loans: Exploring USDA, FHA, VA, and Conventional Options

When it comes to building your dream home, understanding your financing options is crucial. Among these, [...]

USDA Seller Concessions and Closing Costs

USDA Seller Concessions and Closing Costs: Introduction Navigating the world of home financing can be complex, especially for first-time [...]

2024 USDA Home Loan Trends and Updates

Embracing New Opportunities: USDA Home Loan's Expanded Eligibility in [...]

FHA Loan vs. USDA Loan: Understanding the Differences and Benefits

FHA Loan vs. USDA Loan: Understanding the Differences and Benefits When it comes to home loans, the FHA (Federal Housing Administration) and [...]

Why the USDA Home Loan is One of the Best Options for Suburban and Rural Buyers

Introduction: When it comes to buying a home in suburban or rural areas, many potential homeowners face various [...]

The Advantages of Refinancing a USDA Loan

The Advantages of Refinancing a USDA Loan Introduction Refinancing a United States Department of Agriculture (USDA) loan can offer numerous [...]

The Exciting Adventure of Buying a Home in 2023

The Exciting Adventure of Buying Your First Home Hello, dear readers! Today, we're embarking on one of the most thrilling journeys in an [...]

The Best Cities in Alabama for First Time Home Buyers

Best Cities in Alabama for First-Time Home Buyers Alabama, known as the Heart of Dixie, is a beautiful state with a rich [...]

Check Mount Morris, MI Property Eligibility 888-767-0554.

More Locations we Service in Michigan.