North Dakota USDA Loan Eligibility

Introduction to USDA Home Loans

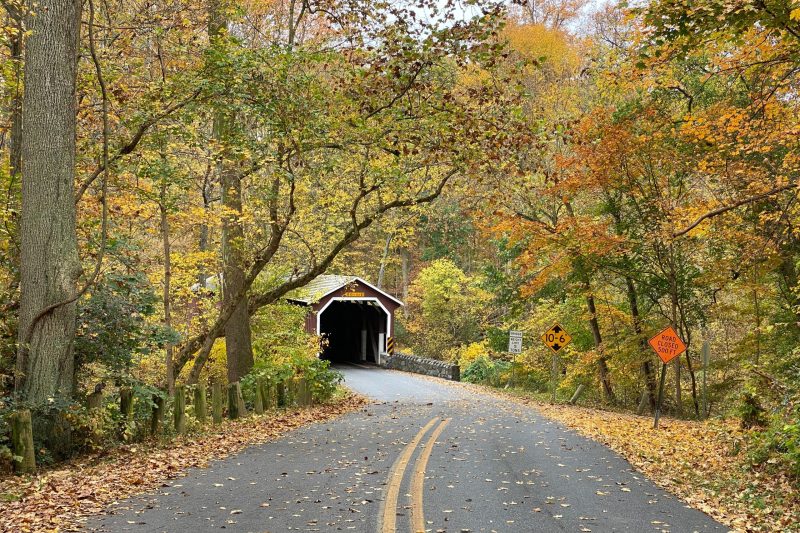

The United States Department of Agriculture (USDA) home loan program offers unique opportunities for homeownership in rural and suburban areas. These loans are designed to promote prosperity in and around North Dakota. making it easier for low-to-moderate-income individuals and families to own a home. North Dakota USDA loans come with several benefits, including no down payment, lower mortgage insurance, and competitive interest rates.

Eligibility Criteria North Dakota USDA Home Loans

1. Location Eligibility

- Rural and Suburban Areas: The property must be located in an area that is designated as rural by the USDA. This often includes suburban and rural areas like North Dakota.

- USDA Property Information: Use our USDA help line 888-767-0554 to check if a specific address or area is eligible.

2. Income Eligibility

- Income Limits: Your household income must not exceed 115% of the median income of the area.

- Adjusted Income: Consideration of certain deductions might lower your adjusted income, potentially qualifying you for the program.

3. Credit Requirements

- Credit Score: A credit score of 620 or higher is typically required, offering streamlined loan processing.

- Credit History: Applicants with lower scores may still be eligible but must meet stricter underwriting standards.

4. Citizenship and Residency

- Legal Status: Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens.

- Primary Residence: The home financed must be your primary residence.

5. Property Eligibility

- Type of Property: Eligible properties include single-family homes, condos, and manufactured homes that meet specific North Dakota USDA standards.

- Condition of Property: The home must be in good livable condition, adhering to USDA health and safety standards.

Call Today (888)767-0554

Application Process

- Prequalification: Start by getting prequalified with our North Dakota USDA lending team. This gives you an idea of what you might be eligible to borrow.

- Find a North Dakota USDA-Eligible Home: We will help you look up eligible areas.

- Complete the Application: Provide all necessary documentation, including income verification, credit information, and details about the desired property. We will walk you through the process.

- Loan Processing and Underwriting: We will process your application and underwrite the loan.

- Approval and Closing: Once approved, you’ll proceed to closing and can then move into your new home.

North Dakota USDA home loans are an excellent option for those looking to buy a home in rural or suburban areas. They offer several benefits over traditional mortgages, including no down payment and more lenient credit requirements. Understanding and meeting the eligibility criteria is crucial for a successful application. Prospective buyers are encouraged to start the process early and work closely with one of our North Dakota USDA professionals.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits North Dakota, IL

Learn More About North Dakota, IL

North Dakota (.mw-parser-output .IPA-label-small{font-size:85%}.mw-parser-output .references .IPA-label-small,.mw-parser-output .infobox .IPA-label-small,.mw-parser-output .navbox .IPA-label-small{font-size:100%} /dəˈkoʊtə/ ⓘ də-KOH-tə)[4] is a landlocked U.S. state in the Upper Midwest, named after the indigenous Dakota Sioux. It is bordered by the Canadian provinces of Saskatchewan and Manitoba to the north and by the U.S. states of Minnesota to the east, South Dakota to the south, and Montana to the west. North Dakota is part of the Great Plains region, characterized by broad prairies, steppe, temperate savanna, badlands, and farmland. North Dakota is the 19th largest state, but with a population of less than 780,000, it is the 4th least populous and 4th most sparsely populated.[note 1] The state capital is Bismarck while the most populous city is Fargo, which accounts for nearly a fifth of the state’s population; both cities are among the fastest-growing in the U.S., although half of all residents live in rural areas.

Get the Latest USDA Mortgage News!

Great cities in New York for First Time Home Buyers

What cities in New York are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in North Carolina for First Time Home Buyers

What cities in North Carolina are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in North Dakota for First Time Home Buyers

What cities in North Dakota are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Ohio for First Time Home Buyers

What cities in Ohio are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Oklahoma for First Time home Buyers

What cities in Oklahoma are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Oregon for First Time Home Buyers

What cities in Oregon are great for first time home buyers? BRIAN BIRK | 3-MINUTE READ 7/14/2023 Oregon offers [...]

Great cities in Pennsylvania for First Time Home Buyers

What cities in Pennsylvania are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Rhode Island for First Time Home Buyers

What cities in Rhode Island are great for first time home buyers? BRIAN BIRK | 3-MINUTE READ 711/2023 Rhode [...]

Great cities in South Carolina for First Time Home Buyers

What cities in South Carolina are great for first time home buyers? South Carolina offers several cities that can be great for [...]

Great cities in South Dakota for First Time Home Buyers

What cities in South Dakota are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Check North Dakota Property Eligibility 888-767-0554.

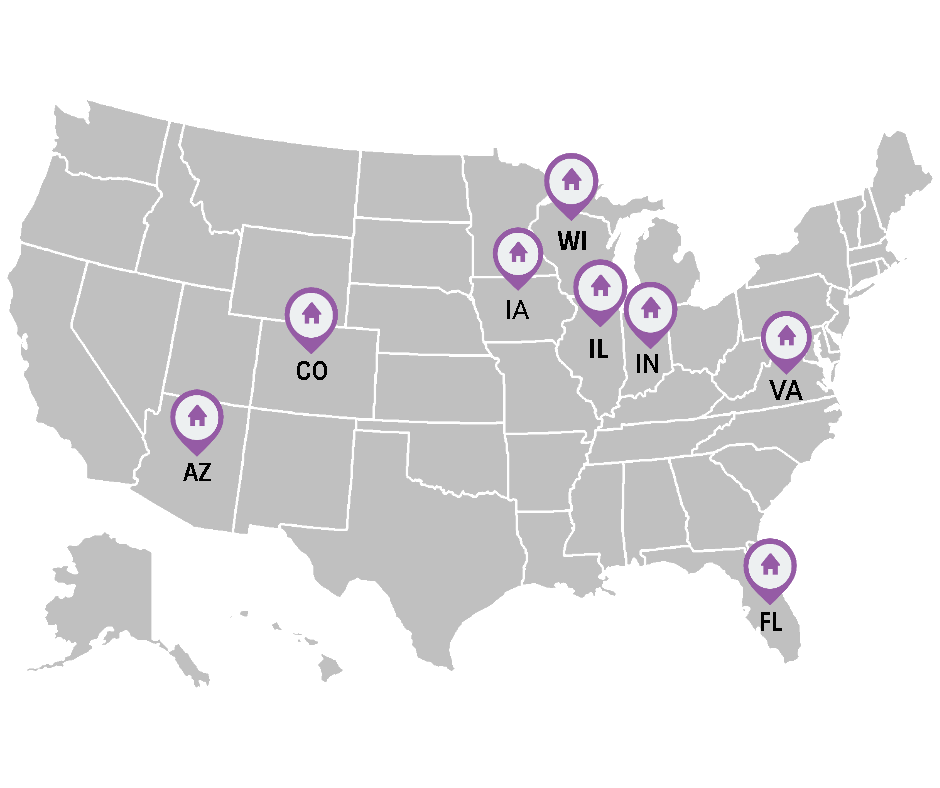

We Service the Following Locations.

- New Jersey USDA Loan Eligibility

- Oregon USDA Loan Eligibility

- West Virginia USDA Loan Eligibility

- Nevada USDA Loan Eligibility

- Rhode Island USDA Loan Eligibility

- Virginia USDA Loan Eligibility

- Georgia USDA Loan Eligibility

- Missouri USDA Loan Eligibility

- Indiana USDA Loan Eligibility

- Minnesota USDA Loan Eligibility

- Idaho USDA Loan Eligibility

- North Carolina USDA Loan Eligibility

- Utah USDA Loan Eligibility

- Vermont USDA Loan Eligibility

- Alabama USDA Loan Eligibility

- Michigan USDA Loan Eligibility

- Pennsylvania USDA Loan Eligibility

- Montana USDA Loan Eligibility

- Illinois USDA Loan Eligibility

- Kentucky USDA Loan Eligibility

- Florida USDA Loan Eligibility

- Arizona USDA Loan Eligibility

- Hawaii USDA Loan Eligibility

- Connecticut USDA Loan Eligibility

- New Mexico USDA Loan Eligibility

- Delaware USDA Loan Eligibility

- Maryland USDA Loan Eligibility

- Puerto RIco USDA Loan Eligibility

- Mississippi USDA Loan Eligibility

- Oklahoma USDA Loan Eligibility

- Colorado USDA Loan Eligibility

- South Dakota USDA Loan Eligibility

- New York USDA Loan Eligibility

- Louisiana USDA Loan Eligibility

- Texas USDA Loan Eligibility

- Wyoming USDA Loan Eligibility

- Washington USDA Loan Eligibility

- Alaska USDA Loan Eligibility

- South Carolina USDA Loan Eligibility

- Ohio USDA Loan Eligibility

- Massachusetts USDA Loan Eligibility

- Wisconsin USDA Loan Eligibility

- New Hampshire USDA Loan Eligibility

- Tennessee USDA Loan Eligibility

- Kansas USDA Loan Eligibility

- Nebraska USDA Loan Eligibility

- California USDA Loan Eligibility

- Maine USDA Loan Eligibility

- Arkansas USDA Loan Eligibility

- Iowa USDA Loan Eligibility