USDA Loans with Low Rates

The USDA Home loan is a great choice for borrowers looking to buy a home with NO MONEY DOWN. When home buyers hear USDA rural they often think of farms or underdeveloped areas. In most cases you can find USDA eligible properties just outside of major cities. USDA is creating loans all across the country, including suburban towns that are anything but rural. In fact, in some states, the vast majority of the state is eligible for USDA loans.

Find out if a property is USDA home eligible by calling 888-767-0554. USDA home loan experts are standing by and ready to help. Connect with a licensed USDA specialist, ask questions, see what cities qualify, and get free quotes.

Call Today (888)767-0554

Finding the Perfect Home Loan

Thousands of consumers across the United States are ready for home ownership. Securing the right home loan doesn’t have to be hard, we have solutions for less than perfect credit and even those with little savings or down payment. To help home buyers overcome challenges we offer more programs and the extra benefit of wholesale rates. We simplify the home buying and refinancing challenges presented by 2025 mortgage guidelines. At USDA RuralMortgage.com, our mission is to get you approved for a USDA mortgage and into your home with payments you can afford. Even if you think you won’t qualify, our highly trained specialists will work with you closely on an individual basis to:

- Review your finances to find a payment you can afford.

- Improve your credit score if needed to qualify.

- Obtain pre-approval to shop for a USDA Eligible Home.

- Secure a loan and purchase your new home!

Working around Credit Issues with Top Rated Specialists

The USDA Rural Mortgage team is celebrating its 28th year in business. Our experience allows for consumer mortgage confidence especially with first time home buyers. We navigate consumers through the mortgage process, explain options and find what choice works best for you. We specialize in more than just USDA rural mortgage loans. Check out consumer home buyer GRANT options, FHA loans and our Bad credit home loan options.

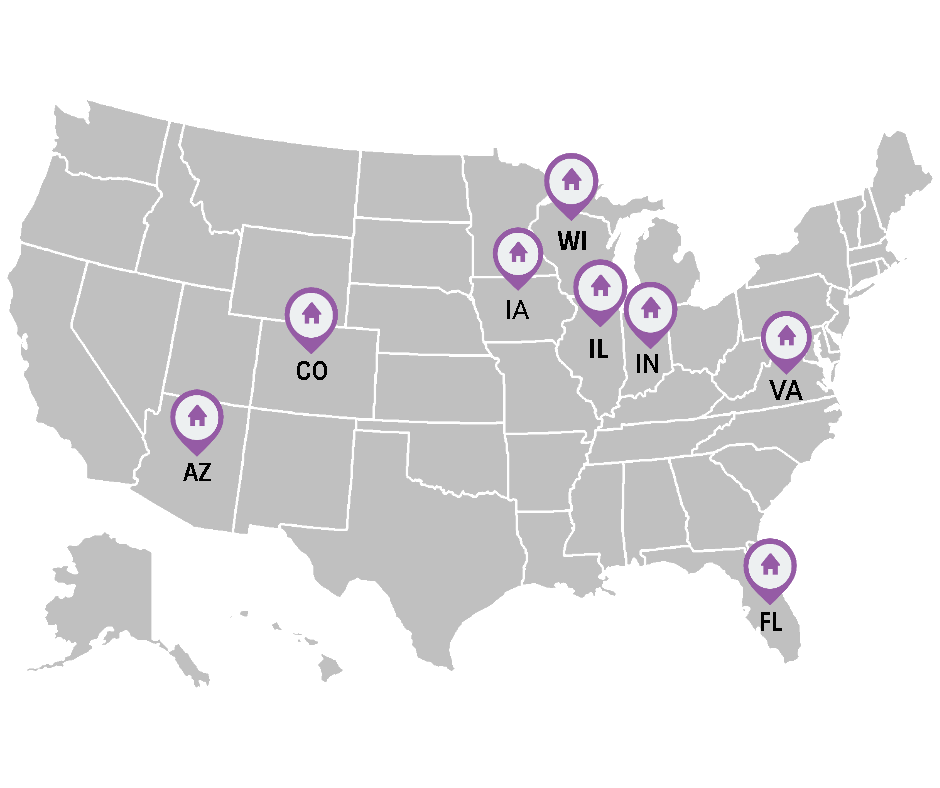

Walk ins are welcome at one of the locations below or everything can be done online by clicking APPLY NOW.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

We Finance Barndominiums

Get into a barndominium with our barndominium financing programs! Single Closing: With a One-Time Close Loan, you only have to close once. This covers both the construction and the mortgage for your barndominium, saving you the hassle and expense of multiple closings.

Get the Latest USDA Mortgage News!

Surprising Iowa Cities That Qualify for USDA Home Loans in 2026 (0% Down Options)

When most buyers think of USDA home loans, they picture farmland or extremely remote areas. In reality, that assumption couldn’t be further from Read more

Surprising Arizona Cities That Qualify for USDA Home Loans (0% Down in 2026)

When most buyers think of USDA home loans, they picture remote farmland or tiny desert towns. In reality, many Arizona cities that feel suburban, Read more

2026 USDA Home Loans: Zero-Down Options for Today’s Homebuyers

2026 USDA Home Loans: Why Zero-Down Home Buying Is About to Matter More Than Ever As we head into the end of the year and look toward 2026, one Read more

Why NOW Is the Best Time to Buy in Rural America

The housing market has shifted again in 2025 — and while many buyers feel priced out, USDA Rural Home Loans remain the most affordable path to Read more

Why Waiting to Buy a Home Could Cost You Thousands — The $0 Down USDA Loan Advantage

For many people, the dream of homeownership feels just out of reach. The most common reasons buyers hold back are the belief that they need a Read more

“Why the USDA Home Loan Is Still the Best-Kept Secret in Homebuying—Even in 2025”

If you’re searching for an affordable path to homeownership in 2025, you’ve probably heard of FHA, VA, or conventional loans. But what if the Read more

🏡 Surprising Towns in Alabama That Qualify for USDA Home Loans

If you're dreaming of owning a home in Alabama and think you need a big down payment or perfect credit—think again! The USDA Rural Development Read more

Why the USDA Home Loan Remains One of the Best Options in Today’s Challenging Market

In today’s uncertain economy — with rising mortgage rates, tight housing inventory, and stubborn inflation — many Americans are wondering if Read more

Why the USDA Home Loan Is the Best Option for Homebuyers This Spring

Spring is one of the busiest seasons for real estate, as families and individuals take advantage of the warmer weather and competitive inventory. Read moreFind your USDA Home Loan 888-767-0554.