Greenville, CA USDA Loan Benefits

Understanding the Benefits of Greenville, CA USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Greenville, CA. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Greenville, CA USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Greenville, CA is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Greenville, CA USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Greenville, CA USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Greenville, CA USDA Loan

1. Streamlined Refinancing

The Greenville, CA USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Greenville, CA can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Greenville, CA USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

To qualify for a Greenville, CA USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Greenville, CA USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Greenville, CA USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Greenville, CA USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Greenville, CA USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

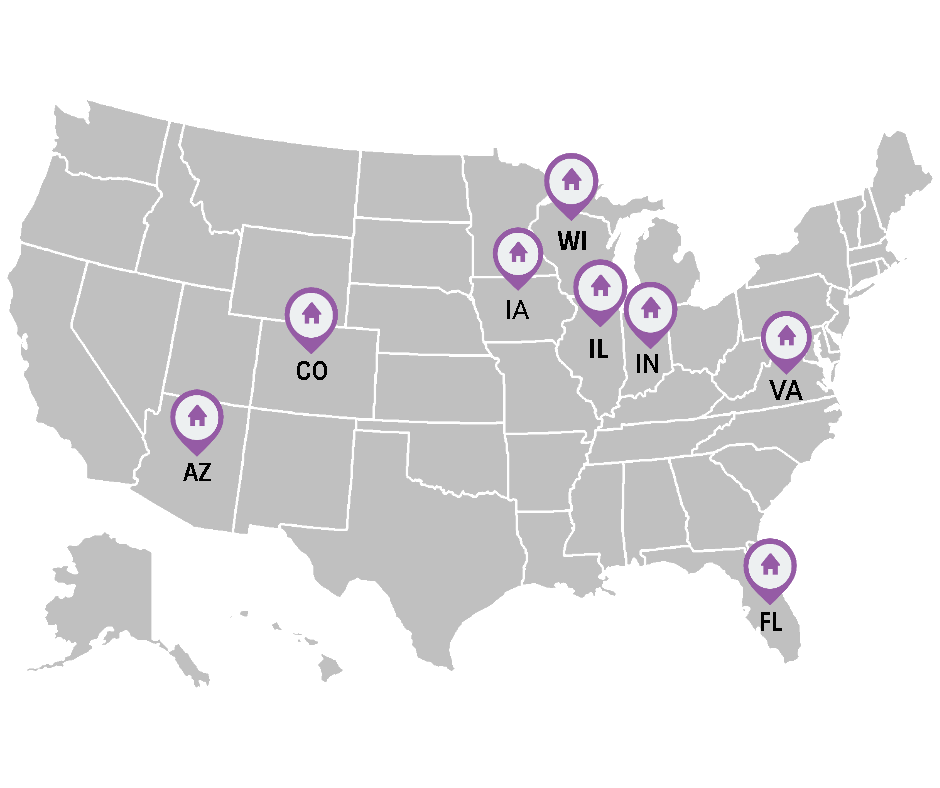

Greenville, CA USDA Maps

Greenville is an unincorporated community in Plumas County, California, United States, on the north-west side of Indian Valley. Most of the buildings were destroyed by the Dixie Fire in August 2021. The population was 1,129 at the 2010 census, down from 1,160 at the 2000 census. For statistical purposes, the United States Census Bureau has defined Greenville as a census-designated place (CDP). According to the Census Bureau, the CDP has a total area of 8.0 square miles (21 km2), all of it land.

Get the Latest USDA Mortgage News!

Why the USDA Home Loan is Ideal for Homebuyers Outside Major Cities

If you’re considering buying a home just outside a bustling metro area, the USDA home loan may be your best option. This loan program, designed [...]

Building Your Barndominium with Ease: One-Time Close Construction Loan Options at USDAruralmortgage.com

The unique appeal of a barndominium – a custom-built home with the rustic charm of a barn and the modern amenities of a home – is drawing more [...]

Understanding Borrower-Paid vs. Lender-Paid Mortgages

Understanding Borrower-Paid vs. Lender-Paid Mortgages with USDAruralmortgage.com When you’re choosing a mortgage, whether it’s for a new home [...]

Refinance Your USDA Rural Mortgage and Skip Two Payments

Refinance Your USDA Rural Mortgage and Skip Two Payments: Perfect Timing for the Holidays! As the holiday season approaches, many homeowners [...]

Understanding Weighted Interest and When to Refinance with USDAruralmortgage.com

For many homeowners, managing multiple debts can be a challenging task, especially when some of those debts carry high-interest rates. [...]

What to Expect When Applying for a USDA Home Loan or Refinance

What to Expect When Applying for a USDA Home Loan or Refinance with USDARuralMortgage.com Applying for a USDA home loan or refinance can be an [...]

Latest Mortgage Rate Drop: Why Now is the Time to Refinance Before the Holidays

As the holiday season approaches, the latest news on mortgage rates has caught the attention of homeowners across the country. Recently, rates [...]

Improve Your Credit Score Before Applying for a Mortgage

How to Improve Your Credit Score Before Applying for a Mortgage with USDAruralmortgage.com If you're planning to buy a home, one of the most [...]

Why Now is the Perfect Time to Refinance or Take a Home Equity Line of Credit

Get Ahead of the Holidays: Why Now is the Perfect Time to Refinance or Take a Home Equity Line of Credit As the summer sun begins to wane and [...]

Why Refinancing Your Home Now in August is a Great Idea

As we progress through August, homeowners are presented with a unique financial opportunity: refinancing their homes. With rising credit card [...]

Find out what California USDA Benefits are Available!

- Tara Hills CA USDA Loan Benefits

- Paramount CA USDA Loan Benefits

- Pleasanton CA USDA Loan Benefits

- Westwood CA USDA Loan Benefits

- Kerman CA USDA Loan Benefits

- Earlimart CA USDA Loan Benefits

- West Point CA USDA Loan Benefits

- Lake of the Pines CA USDA Loan Benefits

- National City CA USDA Loan Benefits

- Cerritos CA USDA Loan Benefits

- Mono Vista CA USDA Loan Benefits

- Rollingwood CA USDA Loan Benefits

- Campbell CA USDA Loan Benefits

- Wilkerson CA USDA Loan Benefits

- Orange Cove CA USDA Loan Benefits

- Stanton CA USDA Loan Benefits

- Searles Valley CA USDA Loan Benefits

- Redwood City CA USDA Loan Benefits

- East Pasadena CA USDA Loan Benefits

- Home Gardens CA USDA Loan Benefits

- Clovis CA USDA Loan Benefits

- Rancho Calaveras CA USDA Loan Benefits

- Arden-Arcade CA USDA Loan Benefits

- Wofford Heights CA USDA Loan Benefits

- Piedmont CA USDA Loan Benefits

- Orinda CA USDA Loan Benefits

- West Athens CA USDA Loan Benefits

- Aptos Hills-Larkin Valley CA USDA Loan Benefits

- San Bernardino CA USDA Loan Benefits

- La Presa CA USDA Loan Benefits