Mount Plymouth, FL USDA Loan Benefits

Understanding the Benefits of Mount Plymouth, FL USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Mount Plymouth, FL. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Mount Plymouth, FL USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Mount Plymouth, FL is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Mount Plymouth, FL USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Mount Plymouth, FL USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Mount Plymouth, FL USDA Loan

1. Streamlined Refinancing

The Mount Plymouth, FL USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Mount Plymouth, FL can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Mount Plymouth, FL USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

To qualify for a Mount Plymouth, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Mount Plymouth, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Mount Plymouth, FL USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Mount Plymouth, FL USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Mount Plymouth, FL USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

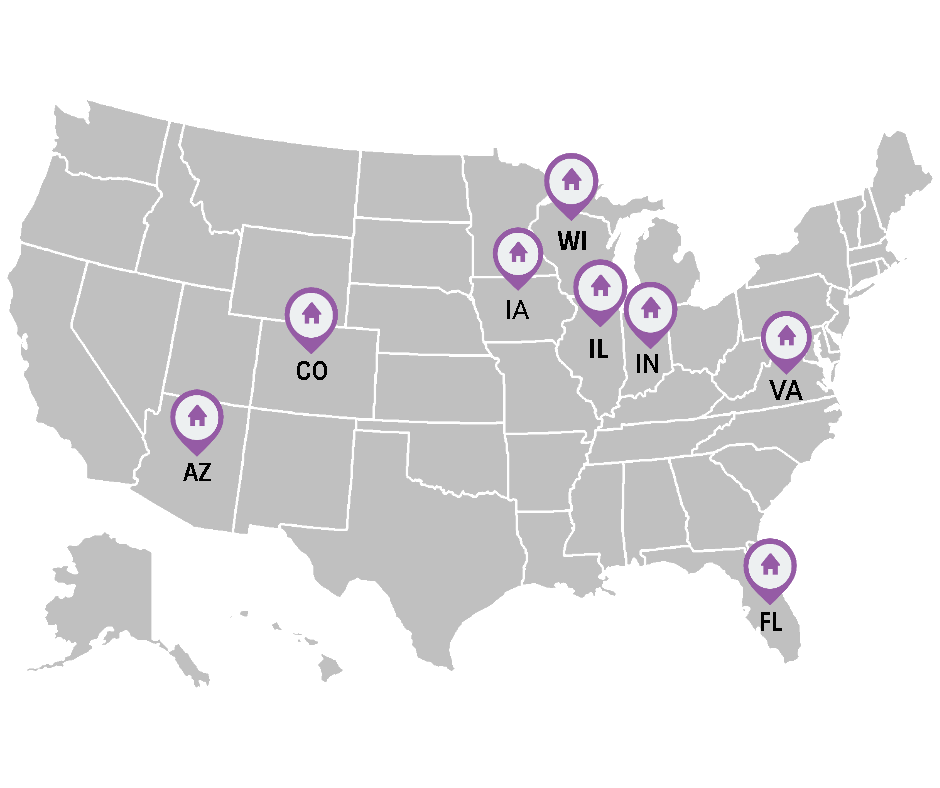

Mount Plymouth, FL USDA Maps

Mount Plymouth is an unincorporated community and census-designated place (CDP) in Lake County, Florida, United States. As of the 2010 census, the CDP population was 4,011,[4] up from 2,814 in 2000.[5] It is part of the Orlando–Kissimmee Metropolitan Statistical Area.

Get the Latest USDA Mortgage News!

The Best Cities in Alaska for First Time Home Buyers

The Best Cities in Alaska for First-Time Home Buyers Alaska, the Last Frontier, is a vast state filled with untouched landscapes, striking [...]

The Best Cities in Arizona for First Time Home Buyers

The Best Cities for First-Time Home Buyers in Arizona Arizona, known for its breathtaking landscapes and rich cultural heritage, is becoming an [...]

The Best Cities in Arkansas for First Time Home Buyers

The Best Cities in Arkansas for First-Time Home Buyers Buying a home for the first time is a big life decision, and where you decide to purchase [...]

The Best Cities in California for First Time Home Buyers

The Best Cities in California for First-Time Home Buyers California, the Golden State, is not just a hub for tech enthusiasts and Hollywood [...]

The Best Cities in Colorado for First Time Home Buyers

The Best Cities in Colorado for First-Time Home Buyers Colorado, with its sweeping landscapes, vibrant culture, and burgeoning economy, has [...]

The Best Cities in Connecticut for First Time Home Buyers

The Best Cities in Connecticut for First-Time Home Buyers Connecticut, often referred to as "The Nutmeg State," offers an enticing blend of [...]

The Best Cities in Delaware for First Time Home Buyers

Best Cities in Delaware for First-Time Home Buyers Delaware, known as the First State since it was the first to ratify the Constitution, has [...]

The Best Cities in Florida for First Time home Buyers

Best Cities in Florida for First-Time Home Buyers Florida, with its beautiful beaches, sunny weather, and diverse culture, has long been a [...]

The Best Cities in Georgia for First Time Home Buyers

The Best Cities in Georgia for First-Time Home Buyers Georgia, affectionately known as the Peach State, offers a rich blend of urban [...]

The Best Cities in Hawaii for First Time Home Buyers

The Best Cities in Hawaii for First-Time Home Buyers Aloha! If you're considering taking a leap into homeownership in the picturesque paradise [...]

Find out about Mount Plymouth, FL USDA Benefits 888-767-0554.

Find out what Florida USDA Benefits are Available!

- Florida City FL USDA Loan Benefits

- Zolfo Springs FL USDA Loan Benefits

- Archer FL USDA Loan Benefits

- Bayport FL USDA Loan Benefits

- Naples FL USDA Loan Benefits

- June Park FL USDA Loan Benefits

- Dania Beach FL USDA Loan Benefits

- Miramar FL USDA Loan Benefits

- Wacissa FL USDA Loan Benefits

- South Patrick Shores FL USDA Loan Benefits

- Everglades FL USDA Loan Benefits

- McIntosh FL USDA Loan Benefits

- Key Vista FL USDA Loan Benefits

- Port St. Lucie FL USDA Loan Benefits

- Newberry FL USDA Loan Benefits

- Pineland FL USDA Loan Benefits

- Ensley FL USDA Loan Benefits

- Macclenny FL USDA Loan Benefits

- Warm Mineral Springs FL USDA Loan Benefits

- Gonzalez FL USDA Loan Benefits

- Wekiwa Springs FL USDA Loan Benefits

- Lake Helen FL USDA Loan Benefits

- Sarasota Springs FL USDA Loan Benefits

- Golden Beach FL USDA Loan Benefits

- Edgewood FL USDA Loan Benefits

- Gateway FL USDA Loan Benefits

- Berrydale FL USDA Loan Benefits

- University Park FL USDA Loan Benefits

- Cross City FL USDA Loan Benefits

- Juno Ridge FL USDA Loan Benefits