Sea Ranch Lakes, FL USDA Loan Benefits

Understanding the Benefits of Sea Ranch Lakes, FL USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Sea Ranch Lakes, FL. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Sea Ranch Lakes, FL USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Sea Ranch Lakes, FL is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Sea Ranch Lakes, FL USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Sea Ranch Lakes, FL USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Sea Ranch Lakes, FL USDA Loan

1. Streamlined Refinancing

The Sea Ranch Lakes, FL USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Sea Ranch Lakes, FL can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Sea Ranch Lakes, FL USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

To qualify for a Sea Ranch Lakes, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Sea Ranch Lakes, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Sea Ranch Lakes, FL USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Sea Ranch Lakes, FL USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Sea Ranch Lakes, FL USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

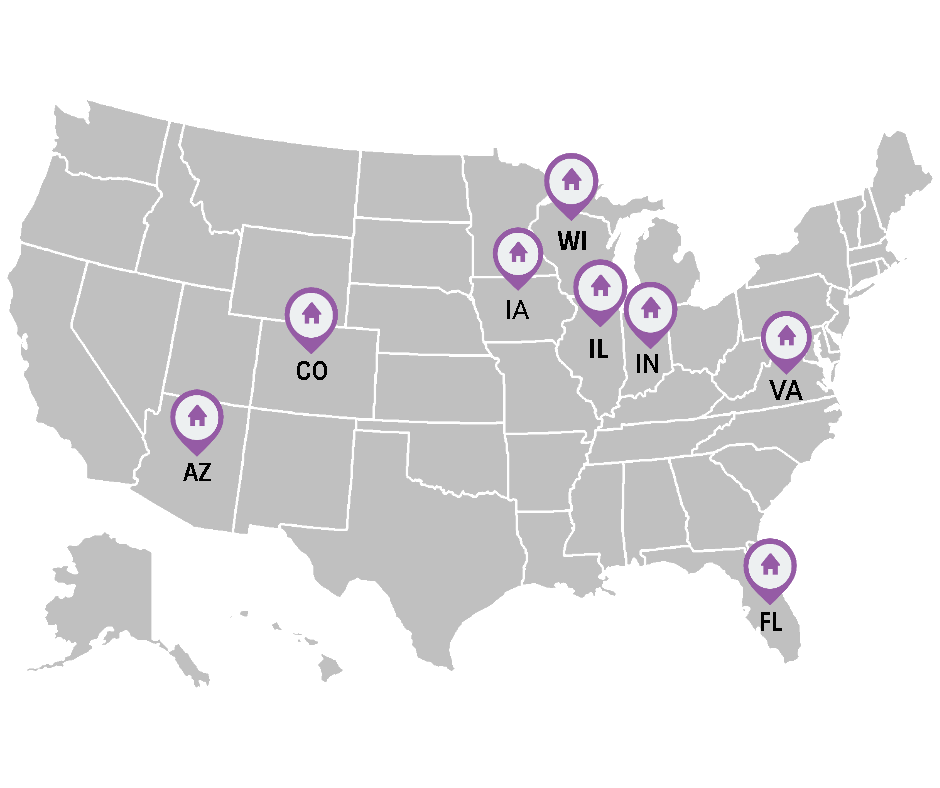

Sea Ranch Lakes, FL USDA Maps

Sea Ranch Lakes is a village in Broward County, Florida, United States. The village is part of Miami metropolitan area of South Florida. It is located on North Ocean Drive (Highway A1A) and is surrounded by Lauderdale-by-the-Sea. The majority of the village is a gated community, with the remainder being a public shopping plaza and a private beach club for village residents, with a pool and access to Sea Ranch Lakes Beach. The population was 540 at the 2020 census.

Get the Latest USDA Mortgage News!

Surprising Towns in Texas That Qualify for NO Money Down USDA Home Loans

When people think of USDA home loans, they often picture rural farmland and remote countryside. However, many surprising towns in Texas qualify [...]

Surprising Cities in Indiana That Qualify for a No Money Down USDA Home Loan

When people think of USDA home loans, they often assume that only remote rural areas qualify. However, many surprisingly well-developed and [...]

Surprising Locations in Florida Where You Can Qualify for a Zero Down USDA Home Loan

When most people think of USDA home loans, they picture rural farmland and remote areas. However, Florida has some unexpected locations where you [...]

USDA Home Loans for Barndominiums and the USDA One-Time Close Program

If you’ve been dreaming of owning a unique and spacious home with a rustic yet modern feel, a barndominium might be the perfect option for you. [...]

Surprising Illinois Cities Where USDA Loans Are Available

When people hear "USDA home loan," they often think of rural farmland and remote locations. However, many towns across Illinois—including some [...]

Why Purchasing a New Home with the USDA Mortgage Option is One of the Best for 2025

The dream of owning a home has never been more achievable, thanks to the USDA mortgage program. As we move into 2025, this mortgage option stands [...]

Refinance Made Easy with USDAruralmortgage.com: Unlock Amazing Benefits!

Refinancing your home has never been simpler or more rewarding than with USDAruralmortgage.com. Whether you’re [...]

USDA Home Loans: Top States and Cities Offering No Money Down Options

When it comes to buying a home, one of the biggest hurdles for many buyers is saving for a down payment. Thankfully, USDA home loans eliminate [...]

Holiday Joy with USDA Loans: Real Stories of Homeownership Success

The holiday season is a time of celebration, togetherness, and new beginnings. For many families, it’s also the perfect time to reflect on the [...]

Why Owning a Home in 2025 Is Easier Than You Think

As we step into 2025, the dream of owning a home is more attainable than ever. With the elections behind us, stability in the housing market has [...]

Find out about Sea Ranch Lakes, FL USDA Benefits 888-767-0554.

Find out what Florida USDA Benefits are Available!

- Bronson FL USDA Loan Benefits

- Oldsmar FL USDA Loan Benefits

- Gladeview FL USDA Loan Benefits

- Bay Hill FL USDA Loan Benefits

- Haverhill FL USDA Loan Benefits

- Jasmine Estates FL USDA Loan Benefits

- South Miami Heights FL USDA Loan Benefits

- Lauderhill FL USDA Loan Benefits

- Watergate FL USDA Loan Benefits

- West Pensacola FL USDA Loan Benefits

- West DeLand FL USDA Loan Benefits

- Stock Island FL USDA Loan Benefits

- Geneva FL USDA Loan Benefits

- Parkland FL USDA Loan Benefits

- Miami Beach FL USDA Loan Benefits

- North Weeki Wachee FL USDA Loan Benefits

- Munson FL USDA Loan Benefits

- Roosevelt Gardens FL USDA Loan Benefits

- Hilliard FL USDA Loan Benefits

- Atlantic Beach FL USDA Loan Benefits

- Palmona Park FL USDA Loan Benefits

- South Beach FL USDA Loan Benefits

- Bristol FL USDA Loan Benefits

- Homosassa Springs FL USDA Loan Benefits

- Golden Gate FL USDA Loan Benefits

- Holiday FL USDA Loan Benefits

- Palm City FL USDA Loan Benefits

- Tamarac FL USDA Loan Benefits

- Bellview FL USDA Loan Benefits

- Pine Ridge FL USDA Loan Benefits