Wimauma, FL USDA Loan Benefits

Understanding the Benefits of Wimauma, FL USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Wimauma, FL. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Wimauma, FL USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Wimauma, FL is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Wimauma, FL USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Wimauma, FL USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Wimauma, FL USDA Loan

1. Streamlined Refinancing

The Wimauma, FL USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Wimauma, FL can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Wimauma, FL USDA program can allow homeowners to tap into their home equity for important expenses.

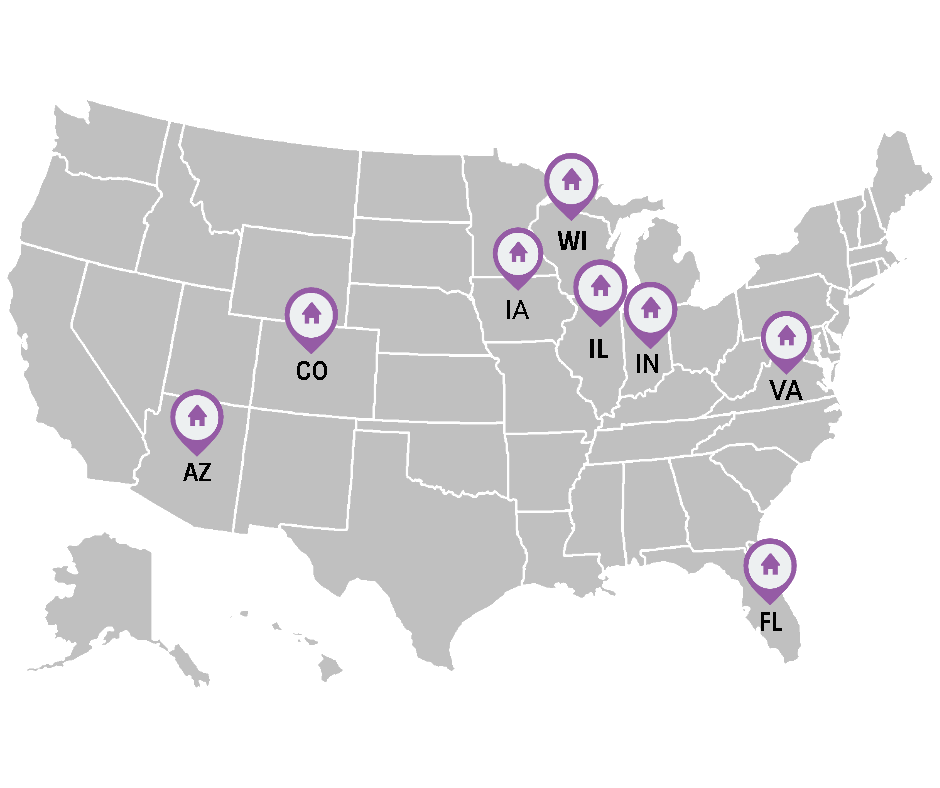

Eligibility and Application

To qualify for a Wimauma, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Wimauma, FL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Wimauma, FL USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Wimauma, FL USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Wimauma, FL USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

Wimauma, FL USDA Maps

Wimauma is an unincorporated census-designated place in Hillsborough County, Florida, United States. The population was 6,373 at the 2010 census,[5] up from 4,246 at the 2000 census.

Get the Latest USDA Mortgage News!

Why Indiana is One of the Best States to Live in the Midwest

Why Indiana is One of the Best States to Live in the Midwest Indiana, often referred to as the "Crossroads of America," is a gem in the Midwest [...]

Exploring Alternatives to USDA Home Loans

Exploring Alternatives to USDA Home Loans: Grants and Down Payment Assistance for All Areas When looking to buy a home, many potential buyers [...]

USDA Loans for Self-Employed Borrowers: A Comprehensive Guide

Purchasing a home can be a daunting task for anyone, but self-employed individuals often face unique challenges, especially when it comes to [...]

USDA New Construction Loans

USDA New Construction Loans: Building Your Dream Home with usdaruralmortgage.com Building a new home from the ground up is an exciting journey, [...]

Discover the Benefits of USDA Home Loans with Usdaruralmortgage.com

For over 27 years, usdaruralmortgage.com has been a trusted name in the USDA loan industry, helping thousands of clients achieve their dreams of [...]

Understanding Seller Concessions: A Guide for Buyers and Sellers on USDAruralmortgage.com

In the world of real estate transactions, "seller concessions" are a vital component that can significantly impact both buyers and sellers. These [...]

No Money Down Home Buying Options in Florida: A Comprehensive Guide

Buying a home is a significant milestone, but the financial burden of a hefty down payment can often be a barrier. In Florida, several "no money [...]

No Money Down Home Buying Options in Indiana

Title: Navigating No Money Down Home Buying Options in Indiana: A Guide for First-Time Buyers Welcome, first-time [...]

Buy a Home with NO Money Down just Outside of Chicago

Title: Making Homeownership a Reality: USDA Loans Just Beyond Chicago Introduction: Dreaming of owning a home near the [...]

The USDA Home Loan

Unveiling the Hidden Gem of Home Financing: The USDA Home Loan In the vast spectrum of home loan options, one gem remains relatively unsung [...]

Find out about Wimauma, FL USDA Benefits 888-767-0554.

Find out what Florida USDA Benefits are Available!

- St. Leo FL USDA Loan Benefits

- Pine Hills FL USDA Loan Benefits

- Fisher Island FL USDA Loan Benefits

- Wellington FL USDA Loan Benefits

- Connerton FL USDA Loan Benefits

- Welaka FL USDA Loan Benefits

- Pea Ridge FL USDA Loan Benefits

- Fuller Heights FL USDA Loan Benefits

- Plantation Mobile Home Park FL USDA Loan Benefits

- Brooker FL USDA Loan Benefits

- Buckhead Ridge FL USDA Loan Benefits

- White Springs FL USDA Loan Benefits

- Montverde FL USDA Loan Benefits

- Port Charlotte FL USDA Loan Benefits

- DeLand FL USDA Loan Benefits

- Maitland FL USDA Loan Benefits

- Palm Beach Gardens FL USDA Loan Benefits

- Deltona FL USDA Loan Benefits

- Lake Hamilton FL USDA Loan Benefits

- Tierra Verde FL USDA Loan Benefits

- Perry FL USDA Loan Benefits

- Brooksville FL USDA Loan Benefits

- Country Club FL USDA Loan Benefits

- Ellenton FL USDA Loan Benefits

- Cypress Quarters FL USDA Loan Benefits

- Palmona Park FL USDA Loan Benefits

- Goulds FL USDA Loan Benefits

- Ormond Beach FL USDA Loan Benefits

- Carrollwood FL USDA Loan Benefits

- Jupiter FL USDA Loan Benefits