Yale, IL USDA Loan Benefits

Understanding the Benefits of Yale, IL USDA Home Loans

The United States Department of Agriculture (USDA) Home Loan program is a government-backed initiative designed to make homeownership more accessible and affordable, particularly in and around Yale, IL. This program offers unique benefits for both purchasing and refinancing homes, aiming to boost the quality of life in these communities.

Key Benefits of Yale, IL USDA Home Loans for Purchasing a Home

1. No Down Payment Required

One of the most significant benefits of a USDA loan in Yale, IL is the zero down payment requirement. This feature opens doors for many potential homeowners who may not have substantial savings.

2. Competitive Interest Rates

Yale, IL USDA loans typically offer lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan.

3. Flexible Credit Guidelines

The program offers more lenient credit requirements, making it easier for those with less-than-perfect credit scores to qualify.

4. 100% Financing

With the ability to finance up to 100% of the home’s value, borrowers can cover the entire purchase price without needing upfront cash.

5. Reduced Mortgage Insurance

Compared to other loan types, Yale, IL USDA loans require lower mortgage insurance premiums, reducing monthly payments.

Call Today (888)767-0554

Benefits of Refinancing a Yale, IL USDA Loan

1. Streamlined Refinancing

The Yale, IL USDA Streamline Refinance program allows for easy refinancing without the need for a new appraisal, credit review, or property inspection, simplifying the process.

2. Lower Monthly Payments

Refinancing a USDA loan in Yale, IL can lead to lower interest rates and monthly payments, providing financial relief to homeowners.

3. No Out-of-Pocket Costs

All refinancing fees can be included in the loan, eliminating the need for upfront payment.

4. Access to Equity

For those who qualify, the Yale, IL USDA program can allow homeowners to tap into their home equity for important expenses.

Eligibility and Application

To qualify for a Yale, IL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Eligibility and Application

To qualify for a Yale, IL USDA Home Loan, applicants must meet certain criteria, including income limits, creditworthiness, and property location. The property must be in an eligible rural or suburban area as defined by the USDA.

Conclusion

Yale, IL USDA Home Loans offer a pathway to homeownership with benefits like no down payment, competitive rates, and flexible credit guidelines. For those looking to refinance, the program provides streamlined options with potential savings. Embracing these benefits can lead to significant financial advantages and a more accessible path to owning or refinancing your home.

Get Started

Ready to explore your options with a Yale, IL USDA Home Loan? Contact our team of experts today to begin your journey towards affordable homeownership or refinancing!

Get on the Path to Home Ownership. We got your Back!

Buy a Home or Refinance

Get Pre-Qualified Now

Yale, IL USDA Benefits

- No down payment required

- Low 30 year fixed rate

- 102% financing (100% plus the guarantee fee that can be financed or paid for by the seller)

- Can finance closing costs if appraisal above sales price

- Competitive rates (as set by the underwriting lenders)

- Minimal mortgage insurance required

- No cash contribution required from borrower

- Gift Funds Allowed

- No maximum loan amount (although there are family income limits)

- No reserves required

- Streamlined credit approval for scores above 640

- Can refinance an existing USDA loan to get a better interest rate if available

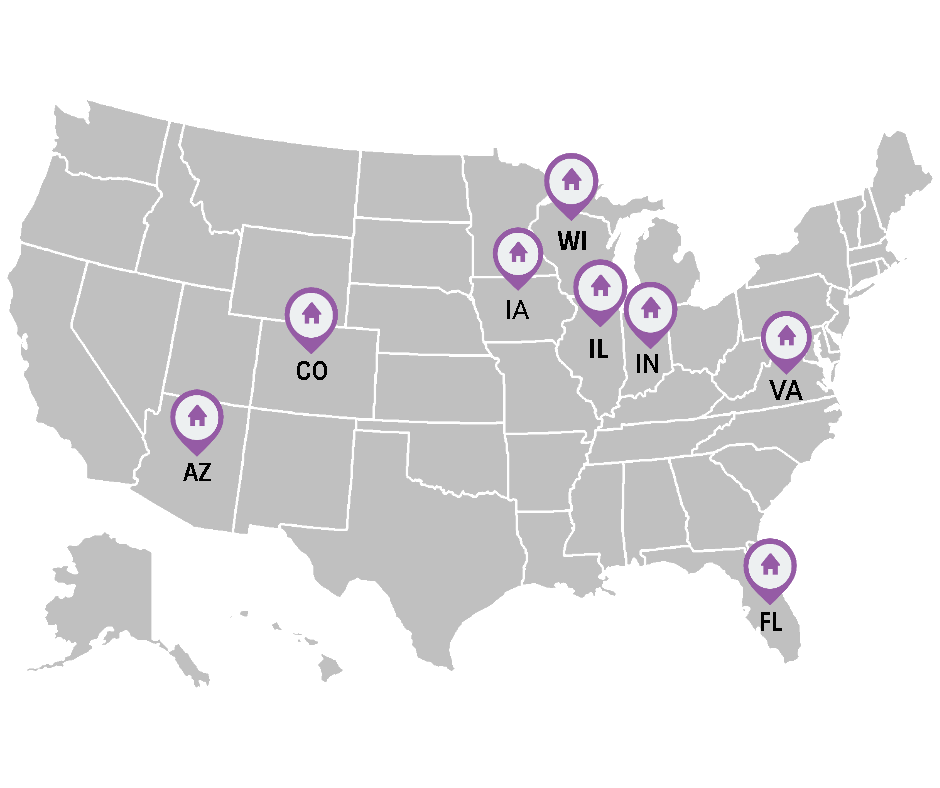

Yale, IL USDA Maps

Yale is a village in Jasper County, Illinois, United States. The population was 86 at the 2010 census.[3]

Get the Latest USDA Mortgage News!

Great cities in Tennessee for First Time Home Buyers

What Cities in Tennessee are Great for First Time Home Buyers? BRIAN BIRK | 3-MINUTE READ 7/1/2023 Tennessee offers several cities [...]

Great Cities in Texas for First Time Home Buyers

What cities in Texas are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Utah for First Time Home Buyers

What Cities in Utah are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great cities in Vermont for First Time Home Buyers

What cities in Vermont are great for first time home buyers? BRIAN BIRK | 3-MINUTE [...]

Great Cities in Virginia for First Time Home Buyers

What cities in Virginia are great for first time home buyers? BRIAN BIRK | 4-MINUTE [...]

Great Cities in Washington for First Time Home buyers

What cities in Washington are great for first time home buyers? BRIAN BIRK | 4-MINUTE [...]

Great Cities in West Virginia for First Time Home Buyers

What cities in West Virginia are great for first time home buyers? BRIAN BIRK | 4-MINUTE [...]

Great cities in Wisconsin for First Time Homebuyers

What Cities are Great for First Time Homebuyers in Wisconsin BRIAN BIRK | 4-MINUTE READ 6/20/2023 Wisconsin offers several cities [...]

Great Cities in Wyoming for First Time Homebuyers

What cities in Wyoming are good for first time home buyers? BRIAN BIRK | 4-MINUTE [...]

USDA Home Loan Closing Cost Guide

BRIAN BIRK | 4-MINUTE READ 5/23/2023 Closing costs are fees and expenses that home buyers pay in the final stage of a property [...]

Find out about Yale, IL USDA Benefits 888-767-0554.

Find out what Illinois USDA Benefits are Available!