Boynton Beach, FL USDA Loan Eligibility

Introduction to USDA Home Loans

The United States Department of Agriculture (USDA) home loan program offers unique opportunities for homeownership in rural and suburban areas. These loans are designed to promote prosperity in and around Boynton Beach, FL, making it easier for low-to-moderate-income individuals and families to own a home. Boynton Beach, DE USDA loans come with several benefits, including no down payment, lower mortgage insurance, and competitive interest rates.

Eligibility Criteria Boynton Beach, FL USDA Home Loans

1. Location Eligibility

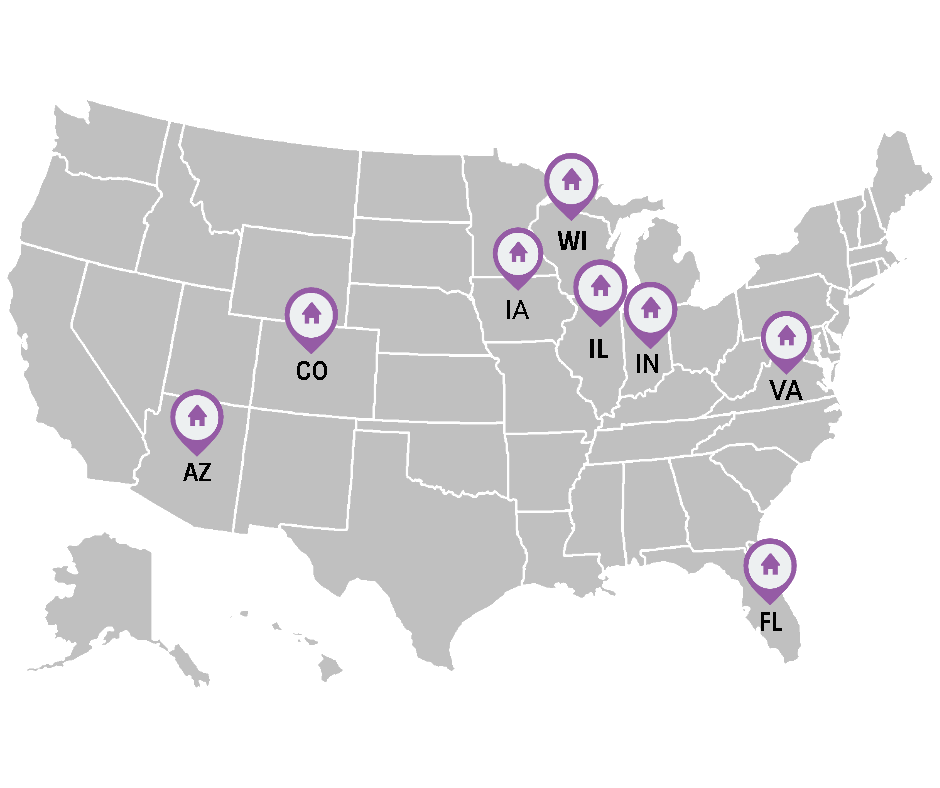

- Rural and Suburban Areas: The property must be located in an area that is designated as rural by the USDA. This often includes suburban and rural areas like Boynton Beach, FL.

- USDA Property Information: Use our USDA help line 888-767-0554 to check if a specific address or area is eligible.

2. Income Eligibility

- Income Limits: Your household income must not exceed 115% of the median income of the area.

- Adjusted Income: Consideration of certain deductions might lower your adjusted income, potentially qualifying you for the program.

3. Credit Requirements

- Credit Score: A credit score of 620 or higher is typically required, offering streamlined loan processing.

- Credit History: Applicants with lower scores may still be eligible but must meet stricter underwriting standards.

4. Citizenship and Residency

- Legal Status: Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens.

- Primary Residence: The home financed must be your primary residence.

5. Property Eligibility

- Type of Property: Eligible properties include single-family homes, condos, and manufactured homes that meet specific Boynton Beach, FL USDA standards.

- Condition of Property: The home must be in good livable condition, adhering to USDA health and safety standards.

Call Today (888)767-0554

Application Process

- Prequalification: Start by getting prequalified with our Boynton Beach, FL USDA lending team. This gives you an idea of what you might be eligible to borrow.

- Find a Boynton Beach, FL USDA-Eligible Home: We will help you look up eligible areas.

- Complete the Application: Provide all necessary documentation, including income verification, credit information, and details about the desired property. We will walk you through the process.

- Loan Processing and Underwriting: We will process your application and underwrite the loan.

- Approval and Closing: Once approved, you’ll proceed to closing and can then move into your new home.

Boynton Beach, FL USDA home loans are an excellent option for those looking to buy a home in rural or suburban areas. They offer several benefits over traditional mortgages, including no down payment and more lenient credit requirements. Understanding and meeting the eligibility criteria is crucial for a successful application. Prospective buyers are encouraged to start the process early and work closely with one of our Boynton Beach, FL USDA professionals.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits Boynton Beach, FL

Learn More About Boynton Beach, FL

Boynton Beach is a city in Palm Beach County, Florida, United States. It is situated about 57 miles (92 km) north of Miami. The 2020 census recorded a population of 80,380. Boynton Beach is located in the Miami metropolitan area of South Florida, which was home to 6,138,333 people at the 2020 census. The city is named after Nathan Boynton, a Civil War major and Michigan politician who became one of the first settlers in the area in 1895. Boynton Beach is located north of Delray Beach, south of Hypoluxo and Lantana, and east of Golf, while the municipalities of Briny Breezes, Gulf Stream, Manalapan, and Ocean Ridge are situated to the east across the Intracoastal Waterway.

Get the Latest USDA Mortgage News!

Why Indiana is One of the Best States to Live in the Midwest

Why Indiana is One of the Best States to Live in the Midwest Indiana, often referred to as the "Crossroads of America," is a gem in the Midwest [...]

Exploring Alternatives to USDA Home Loans

Exploring Alternatives to USDA Home Loans: Grants and Down Payment Assistance for All Areas When looking to buy a home, many potential buyers [...]

USDA Loans for Self-Employed Borrowers: A Comprehensive Guide

Purchasing a home can be a daunting task for anyone, but self-employed individuals often face unique challenges, especially when it comes to [...]

USDA New Construction Loans

USDA New Construction Loans: Building Your Dream Home with usdaruralmortgage.com Building a new home from the ground up is an exciting journey, [...]

Discover the Benefits of USDA Home Loans with Usdaruralmortgage.com

For over 27 years, usdaruralmortgage.com has been a trusted name in the USDA loan industry, helping thousands of clients achieve their dreams of [...]

Understanding Seller Concessions: A Guide for Buyers and Sellers on USDAruralmortgage.com

In the world of real estate transactions, "seller concessions" are a vital component that can significantly impact both buyers and sellers. These [...]

No Money Down Home Buying Options in Florida: A Comprehensive Guide

Buying a home is a significant milestone, but the financial burden of a hefty down payment can often be a barrier. In Florida, several "no money [...]

No Money Down Home Buying Options in Indiana

Title: Navigating No Money Down Home Buying Options in Indiana: A Guide for First-Time Buyers Welcome, first-time [...]

Buy a Home with NO Money Down just Outside of Chicago

Title: Making Homeownership a Reality: USDA Loans Just Beyond Chicago Introduction: Dreaming of owning a home near the [...]

The USDA Home Loan

Unveiling the Hidden Gem of Home Financing: The USDA Home Loan In the vast spectrum of home loan options, one gem remains relatively unsung [...]

Check Boynton Beach, FL Property Eligibility 888-767-0554.

More Locations we Service in Florida.