Orangeville, IL USDA Loan Eligibility

Introduction to USDA Home Loans

The United States Department of Agriculture (USDA) home loan program offers unique opportunities for homeownership in rural and suburban areas. These loans are designed to promote prosperity in and around Orangeville, IL, making it easier for low-to-moderate-income individuals and families to own a home. Orangeville, IL USDA loans come with several benefits, including no down payment, lower mortgage insurance, and competitive interest rates.

Eligibility Criteria Orangeville, IL USDA Home Loans

1. Location Eligibility

- Rural and Suburban Areas: The property must be located in an area that is designated as rural by the USDA. This often includes suburban and rural areas like Orangeville, IL.

- USDA Property Information: Use our USDA help line 888-767-0554 to check if a specific address or area is eligible.

2. Income Eligibility

- Income Limits: Your household income must not exceed 115% of the median income of the area.

- Adjusted Income: Consideration of certain deductions might lower your adjusted income, potentially qualifying you for the program.

3. Credit Requirements

- Credit Score: A credit score of 620 or higher is typically required, offering streamlined loan processing.

- Credit History: Applicants with lower scores may still be eligible but must meet stricter underwriting standards.

4. Citizenship and Residency

- Legal Status: Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens.

- Primary Residence: The home financed must be your primary residence.

5. Property Eligibility

- Type of Property: Eligible properties include single-family homes, condos, and manufactured homes that meet specific Orangeville, IL USDA standards.

- Condition of Property: The home must be in good livable condition, adhering to USDA health and safety standards.

Call Today (888)767-0554

Application Process

- Prequalification: Start by getting prequalified with our Orangeville, IL USDA lending team. This gives you an idea of what you might be eligible to borrow.

- Find a Orangeville, IL USDA-Eligible Home: We will help you look up eligible areas.

- Complete the Application: Provide all necessary documentation, including income verification, credit information, and details about the desired property. We will walk you through the process.

- Loan Processing and Underwriting: We will process your application and underwrite the loan.

- Approval and Closing: Once approved, you’ll proceed to closing and can then move into your new home.

Orangeville, IL USDA home loans are an excellent option for those looking to buy a home in rural or suburban areas. They offer several benefits over traditional mortgages, including no down payment and more lenient credit requirements. Understanding and meeting the eligibility criteria is crucial for a successful application. Prospective buyers are encouraged to start the process early and work closely with one of our Orangeville, IL USDA professionals.

Get on the Path to Home Ownership. We got your Back!

Buy a Home with No Money Down

Get Pre-Qualified Now

USDA Benefits Orangeville, IL

Learn More About Orangeville, IL

Orangeville is a village in Stephenson County, Illinois, United States. The town’s sign lists the population at 800 as of January 2021. The population in 2020 was 738. The population according to the 2010 census was 793, up from 751 in 2000. Using the 2020 population of 738 Orangeville is the 741st largest city in Illinois and the 11,650th largest city in the United States. Orangeville is currently declining at a rate of -0.94% annually and its population has decreased by -6.94% since the 2010 census. The area’s earliest white settlers arrived in the year 1833, and the village was platted in 1851 by John Bower, who is considered the village founder. In 1867 Orangeville was incorporated as a village. The town’s central business district contains several 19th century commercial buildings, many of which were built during the railroad boom of 1888–1914. By the time the Great Depression was ongoing, business in Orangeville had started to decline, with the last bank closing in 1932. In 1956 another bank started operating in the village and is still in town today. Some recent infrastructure jumps have restored some of the village’s old decor.

Get the Latest USDA Mortgage News!

Great cities in Michigan for First Time Home Buyers

What cities in Michigan are great for first time home buyers? Choosing the best cities in Michigan for [...]

Great cities in Minnesota for First Time Home Buyers

What cities in Minnesota are great for first time home buyers? Minnesota, known as the "Land of 10,000 Lakes," [...]

Great cities in Mississippi for First Time Home Buyers

What cities in Mississippi are great for first time home buyers? Selecting the best cities for first-time home [...]

Great cities in Missouri for First Time Home Buyers

What cities in Missouri are great for first time home buyers? When looking for a good city for a first-time [...]

Great cities in Montana for First Time Home Buyers

What cities in Montana are great for first time home buyers? Montana offers several cities that can be great [...]

Great cities in Nebraska for First Time Home Buyers

What cities in Nebraska are great for first time home buyers? BRIAN BIRK | 3-MINUTE READ Nebraska offers several cities that [...]

Great cities in Nevada for First Time Home Buyers

What cities in Nevada are great for first time home buyers? BRIAN BIRK | 3-MINUTE READ Nevada offers [...]

Great cities in New Hampshire for First Time Home Buyers

Finding Your First Home: Ideal Cities in New Hampshire for First-Time Buyers Introduction: Deciding to purchase [...]

Great cities in New Jersey for First Time Home Buyers

What cities in New Jersey are great for first time home buyers? New Jersey offers several cities that can be [...]

Great cities in New Mexico for First Time Home Buyers

What cities in New Mexico are great for first time home buyers? New Mexico offers several cities that can be [...]

Check Orangeville, IL Property Eligibility 888-767-0554.

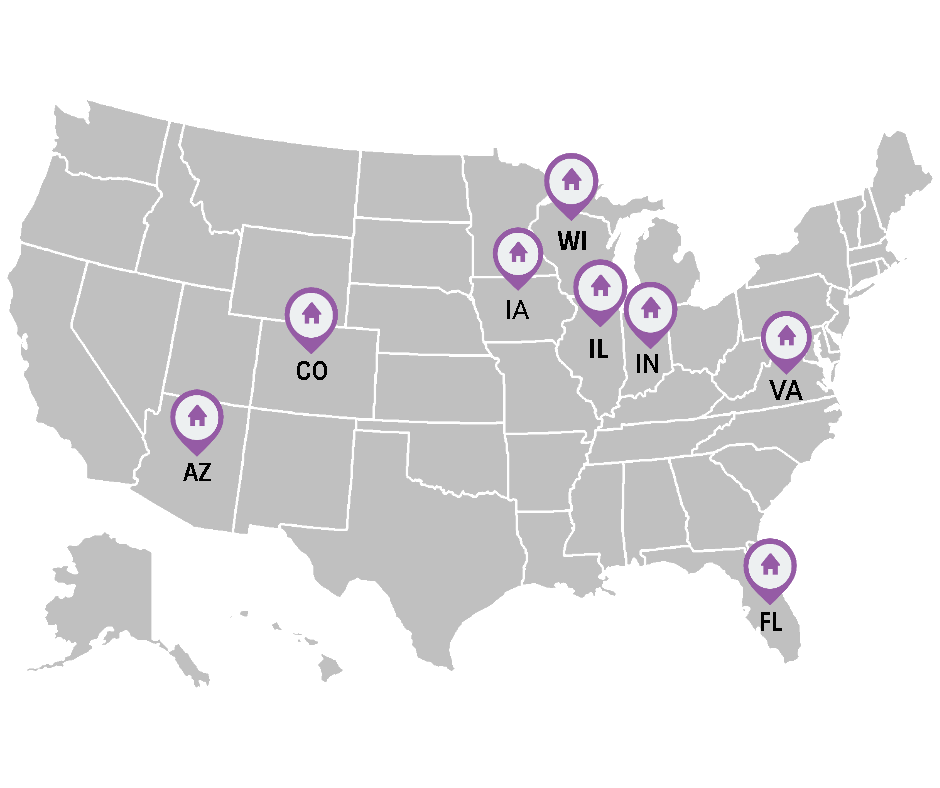

More Locations we Service in Illinois.